Risk and Finance

Not all crises are the same. For professions in the business world that deal with the financial risks of business operations (first and foremost, risk managers, controllers, accountants, chartered accountants, chief risk officers and chief finance officers), the corona crisis turned out to be the first crisis in two decades in which they were not the scapegoat.

Just think about it. In 2000 overly high investor expectations and overly ambitious plans by CFOs, CROs and CEOs meant that the Internet hype ended overnight. Stock prices collapsed, and countless Internet companies went bankrupt. In the ‘new economy’, spending was supposedly more important than earning money. Or maybe not. The Internet crisis then led to the sudden discovery of large-scale fraud in other industries. However, due to deteriorating market conditions, executive directors at American utility company Enron (which went bankrupt) and supermarket group Ahold (which was rescued), among others, were no longer able to keep fraud under the radar. Major accounting scandals followed worldwide. Problems also arose with private equity, which has been on the rise in the Netherlands since the turn of the century. Some parties turned out to have overleveraged their private equity holdings too eagerly. The excesses led to stricter legislation and regulations., such as the Dutch Corporate Governance Code, or the American Sarbanes Oxley Act. Regulators such as the Dutch Central Bank (DNB) and the Netherlands Authority for the Financial Markets (AFM) were given more and more responsibilities and powers, which in turn led to the professionalization of the finance and risk departments at the large corporations.

The rise of the chief risk officer

However, this professionalization could not prevent the next financial crisis from occurring. The credit crunch from 2007 onwards primarily affected the financial and banking sectors. Shortly afterwards, the euro crisis followed, plunging the eurozone and Europe as a whole into crisis. It was precisely in the heart of the capitalist system (the financial sector) that risk rules were systematically evaded and violated. As it turned out, compliance was not the solution. A deep economic crisis followed. Banks faltered or went bankrupt. The European Central Bank (ECB) had to come to the rescue. This crisis led to the rise of the chief risk officer in the boardroom. Particularly in financial groups, the CRO plays a pivotal role. He is not only concerned with rules and compliance but also with encouraging proper conduct. Nowadays the combination is also called Hearts & Minds.

Back to the beginning. How different is the COVID-19 crisis! The economic crisis that began in 2020 was not the result of large-scale fraud or risky conduct, but of a health crisis. The financial professionals are beyond suspicion in this crisis. This is not a crisis of too much debt, too much risk or poor accounting. The crisis is caused primarily by COVID-19 severely restricting everyone's freedom of action. The fact that the finance professional or the chief financial officer are not the culprits does not mean that they have been left alone in this crisis. On the contrary, turnover losses in many industries were unprecedented in 2020. Whether in private equity, listed companies or family-owned businesses, for the CFO it is all hands on deck during the crisis.

Integrated reporting

Finally, this applies not only to risk management or risk control. Auditors are increasingly busy. Frightened by the crises of the past two decades, consumers and investors demand much more transparency and ‘a good story’ from companies. That good story means: are you dealing transparently and correctly with customers, suppliers, employees and other stakeholders? But also: what does the supply chain look like? How sustainable or circular is it? For organizations, this increased social pressure means that they no longer only have to report on financial matters, but also on matters such as sustainability and good governance. Integrated reporting, it is called. What started out as the Sustainability Report, in which companies talk about their sustainability aspirations, is increasingly becoming a central part of business operations and therefore accounting practices.

.jpg)

Linde Jansen (PostNL): ‘Finance is a frontrunner’

After a long career at brewer Heineken, Linde Jansen moved to postal company PostNL in the spring of 2025 for her very first role as CFO. She could immediately get involved with a new strategy. Jansen is not a CFO who only focuses on the numbers: ‘As finance, we are truly transformation leaders, not transformation supporters.’

Read moreDigitization forms the basis of the economy and is rapidly changing how organizations function. But dependence on digitization increases vulnerability. It is therefore critical for organizations to have their digital resilience in order. This is only possible if cybersecurity is not seen solely as a technical IT issue, but also as a strategic issue for which the top management of the organization is ultimately responsible. Chantal Vergouw of KPN identifies three strategic shifts that will be decisive in this regard.

Mark Rutten has been CFO and a member of the executive board of brewer Royal Swinkels since 2024. He came over from competitor Heineken, where he worked abroad for many years. His ambitions at Swinkels? To think more internationally and be a little bolder when it comes to investments. ‘Yes, that is probably the opposite of what you would expect from a CFO.’

Digital resilience is a matter for top management

Digitization forms the basis of the economy and is rapidly changing how organizations function. But dependence on digitization increases vulnerability. It is therefore critical for organizations to have their digital resilience in order. This is only possible if cybersecurity is not seen solely as a technical IT issue, but also as a strategic issue for which the top management of the organization is ultimately responsible. Chantal Vergouw of KPN identifies three strategic shifts that will be decisive in this regard.

Mark Rutten (Swinkels): ‘We can make bigger investments’

Mark Rutten has been CFO and a member of the executive board of brewer Royal Swinkels since 2024. He came over from competitor Heineken, where he worked abroad for many years. His ambitions at Swinkels? To think more internationally and be a little bolder when it comes to investments. ‘Yes, that is probably the opposite of what you would expect from a CFO.’

Recent figures from the Netherlands Bureau for Economic Policy Analysis (CPB) and ABN AMRO paint a positive picture of Dutch purchasing power. Households with incomes between €21,000 and €70,000 had more disposable income in 2023 than in 2019, despite sharp price increases.However, a new study by Deloitte, Financial health of Dutch households, shows that almost half of all Dutch households – 47 percent – are nevertheless financially vulnerable or unhealthy. What can be done about this?

Bas Brouns has been working in various financial positions at KLM for almost 30 years. As CFO since April 2024, he is ultimately responsible for the finances of the Dutch airline. Brouns took his seat in the financial cockpit at a crucial moment. KLM needs to invest billions in fleet renewal, while profitability is lagging behind that of sister company Air France. But, ‘KLM seems not made for quick growth.’

International tensions and an escalating trade war are causing great uncertainty. The role of CFOs – who will have to adapt to new trade flows and be alert to new market opportunities – is more strategic than ever. But there is also reason for optimism, was the message at Deloitte’s recent CFO dinner at the H'art Museum in Amsterdam. ‘Companies that dare to reposition themselves, will see new opportunities opening up.’

Financial vulnerability in the Netherlands

Recent figures from the Netherlands Bureau for Economic Policy Analysis (CPB) and ABN AMRO paint a positive picture of Dutch purchasing power. Households with incomes between €21,000 and €70,000 had more disposable income in 2023 than in 2019, despite sharp price increases.However, a new study by Deloitte, Financial health of Dutch households, shows that almost half of all Dutch households – 47 percent – are nevertheless financially vulnerable or unhealthy. What can be done about this?

Bas Brouns (KLM): ‘Our main aim is increasing the margin’

Bas Brouns has been working in various financial positions at KLM for almost 30 years. As CFO since April 2024, he is ultimately responsible for the finances of the Dutch airline. Brouns took his seat in the financial cockpit at a crucial moment. KLM needs to invest billions in fleet renewal, while profitability is lagging behind that of sister company Air France. But, ‘KLM seems not made for quick growth.’

The CFO as strategic navigator in a new world order

International tensions and an escalating trade war are causing great uncertainty. The role of CFOs – who will have to adapt to new trade flows and be alert to new market opportunities – is more strategic than ever. But there is also reason for optimism, was the message at Deloitte’s recent CFO dinner at the H'art Museum in Amsterdam. ‘Companies that dare to reposition themselves, will see new opportunities opening up.’

René van Vlerken (Euronext): ‘The end goal is a European capital market’

Euronext CEO René van Vlerken has concerns about the Dutch and European capital markets. The urgency for the creation of a European capital market has grown enormously, and so consolidating it is his most important challenge. ‘There is enough capital, but the market in Europe is too fragmented.’

Read moreMost read

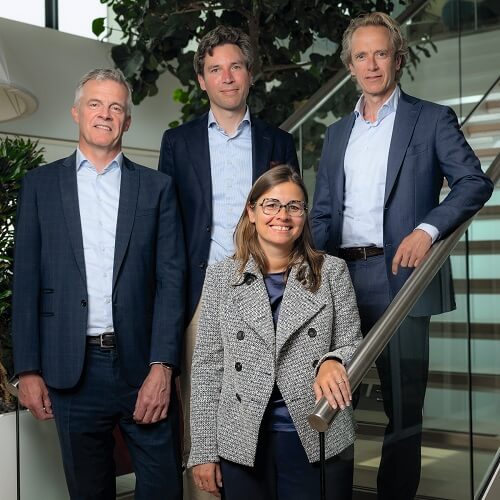

The CFO as Challenger and Driving Force

The experts at our roundtable shed light on financial management for a sustainable future. Determining the pace at which to proceed is where the CFO should lead the way. ‘The CFO determines the pace at which the organization takes the steps.’

NIS2 Directive: Cybersecurity Is a Joint Responsibility

Europe is preparing for the digital age. Unambiguous European regulations, directives and rules are of significant importance in the digital society and economy. In this light, organizations should not see the NIS2 directive as merely adding to regulatory burdens, but primarily as an opportunity.

Frederik van der Schoot and Gerbrand ter Brugge (Oaklins): 'An Opportunity Might Come Only Once'

CFO Survey Deloitte: How to survive the CFO Triangle

CFOs, Be Honest About the Feasibility of Sustainability Ambitions

The CFO as Challenger and Driving Force

From Changemaker CFO to Chief Value Officer

Leon van Riet (NN Group) on the Pension Transition: ‘Time to Dive In’

Deloitte CFO Survey: Finance and Artificial Intelligence Make a Great Combination

The regulations regarding partner- and orphan pension, among many other things, will change under the new Future Pensions Act (Wet Toekomst Pensioenen or WTP). Employers who want to avoid financial problems for surviving relatives should take action now, according to senior sales consultant Joost de Visser of elipsLife. ‘January 1, 2028, is closer than you think.’

A key role is reserved for the CFO in the sustainability transition of companies, who in practice occasionally appears to struggle with its interpretation. According to Pim Rossen and Alexander Tamminga of strategic consulting firm Kearney, now is the time to introduce a new paradigm with a better balance between short- and long-term value creation. ‘Adapt existing KPIs to the transformation phase of the company.’

The Three-Pronged Approach Called Partner Pension Becomes A Complicated Puzzle

The regulations regarding partner- and orphan pension, among many other things, will change under the new Future Pensions Act (Wet Toekomst Pensioenen or WTP). Employers who want to avoid financial problems for surviving relatives should take action now, according to senior sales consultant Joost de Visser of elipsLife. ‘January 1, 2028, is closer than you think.’

Sustainability As Key Role For The CFO

A key role is reserved for the CFO in the sustainability transition of companies, who in practice occasionally appears to struggle with its interpretation. According to Pim Rossen and Alexander Tamminga of strategic consulting firm Kearney, now is the time to introduce a new paradigm with a better balance between short- and long-term value creation. ‘Adapt existing KPIs to the transformation phase of the company.’

CFO, Seize Your Role as Catalyst and Strategist

The First 100 Days as CFO of Triodos Bank

Head of ING Investor Relations, Mark Milders, Brings the Story Behind the Numbers

The CFO is No Longer the Doomsayer Now That the Entire Board Is Thinking in Scenarios

Deloitte CFO Survey: Optimism About the Future

.jpg)

.jpg)